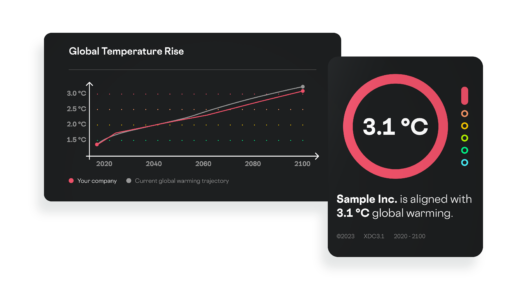

Your climate impact in °C

Get a snapshot of your current climate impact, clearly expressed in degrees Celsius.

Get a snapshot of your current climate impact, clearly expressed in degrees Celsius.

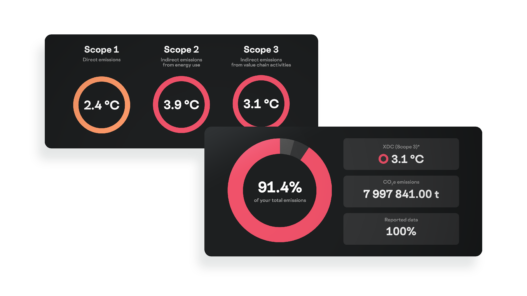

Identify your most critical emissions scopes and apply targeted mitigation strategies to minimise your climate impact.

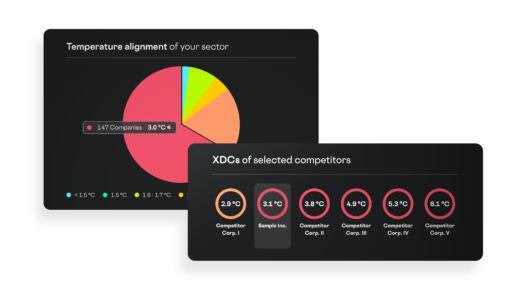

Compare your current compatibility with the 1.5°C target and see how you stack up against your competitors and your sector.

Pinpoint your remaining emissions budget for 1.5°C-compatibility and explore potential pathways for staying on target.

Communicate your current alignment with the impactful XDC temperature badge (valid for one year), available as an authenticated NFT (non-fungible token).

From EUR 915* plus VAT

*For companies not subject to mandatory reporting under the Corporate Sustainability Reporting Directive (CSRD)

Want to learn more?

REFERENCE

It’s not the cow, it’s the how: Strategies for Paris-compatible meat production

See whether your portfolio fulfills your temperature targets and where the greatest deviations occur.

Take your ESG reporting to the next level by including science-based, forward-looking climate metrics.

Verify our broad data coverage in advance – including listed and private equity, bonds and sovereign bonds.

You send us the ISINs and portfolio weights and our team of financial experts will do the rest. Receive your report as a useful Excel file, including an in-depth discussion of the findings with our consultants.

See the climate impact of your investments at first view. Identify the best and worst climate performers among your holdings and explore in detail the changes you can make through rebalancing. Make the most of our user-friendly, web-based software to actively manage your portfolio along science-based, forward-looking climate KPIs.

When talking about climate change, what could be easier than degrees Celsius? Make your climate reporting tangible and transparent with all the accuracy of a science-based, robust metric and all the simplicity of a single value: °C

What is the portfolio’s temperature trajectory if things continue as before until 2050 or 2100? How does this align with the Paris Agreement goals? A unique combination of bottom-up baseline calculations and top-down target benchmarking gives you full insight into where your investments are headed.

XDC Portfolio Explorer covers 80+ sectors (NACE classification) and offers immediate access to temperature alignment results for approx. 6,000 listed companies plus 168 sovereign bonds. Just upload your portfolio (.csv) and get started for free.

Choose the Premium version to get full feature access, including

Add the Sovereign Bonds module to get your full multi-asset portfolio analysis in one seamless tool.

See more and register for free at portfolio.xdegreecompatible.com

See your building stock’s climate performance, where the greatest climate risks lie, and what decarbonisation pathways to 1.5°C-alignment would look like. It’s easier than you think! Data on area, building type, country, and emissions (Whole Buildings Approach) are converted into one single figure: X °C.

Our innovative X-Degree Compatibility (XDC) Model marries economy and science: Based on the CRREM decarbonisation pathways, we measure the performance of each building against its 1.5°C-aligned benchmark (depending on country and building type) and then calculate: What if the whole world operated as this building does?

By integrating a climate model, we bring the best available (climate) science into our calculations, giving you everything you need in one number: reliability, transparency, international comparability – all based on science.

Which refurbishment measure is the right choice? When is the best time for it? How can renovation plans be adjusted to maximise their effect? And, most importantly: Will the planned optimisations be sufficient to bring the buildin, the quarter or the portfolio on track for 1.5°C?

Use scenario analysis in XDC Real Estate Explorer to check the effectiveness of your plans, before investing in them.

Impress your customers and investors with sound, tangible, and intuitive climate metrics. Use forward looking KPIs to not only show how carbon-intensive your real estate is now, but to demonstrate that your modernisations are 1.5°C-compatible. Make the transition possible!

Use our own browser-based application, XDC Real Estate Explorer, to analyse your buildings directly. Or integrate our climate metrics into your own systems through an API.

Want to learn more?

Quantrefy is the world’s first platform that enables real-time calculation of ESG scores for real estate (e.g. GRESB, ECORE or CRREM). It provides you with a customisable dashboard for this purpose.

Quantrefy not only simplifies your reporting, but also provides you with concrete information on where and how you can sustainably improve the ESG scoring of your real estate portfolio. You can integrate XDC for Real Estate directly into your Quantrefy dashboard.