From Article 9 to the EU Taxonomy, from the UK’s Transition Plan Taskforce to BaFin, the pressure is rising for finance and investment to gain a full understanding of their portfolio’s climate impact. With our new additions to XDC Portfolio Explorer we’ve just made that a lot easier. Here’s an overview of the changes we’ve made:

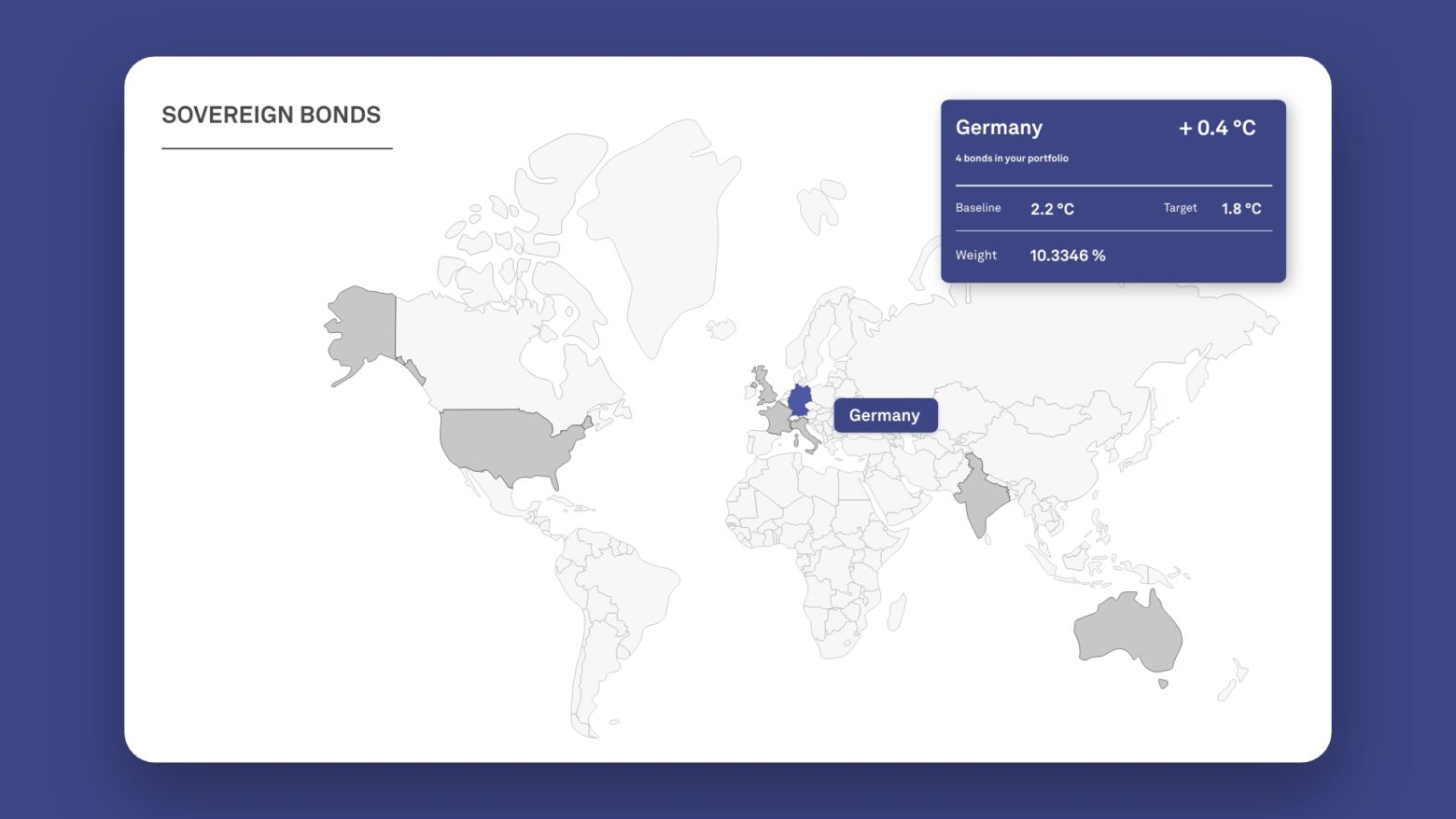

Introducing Sovereign Bonds

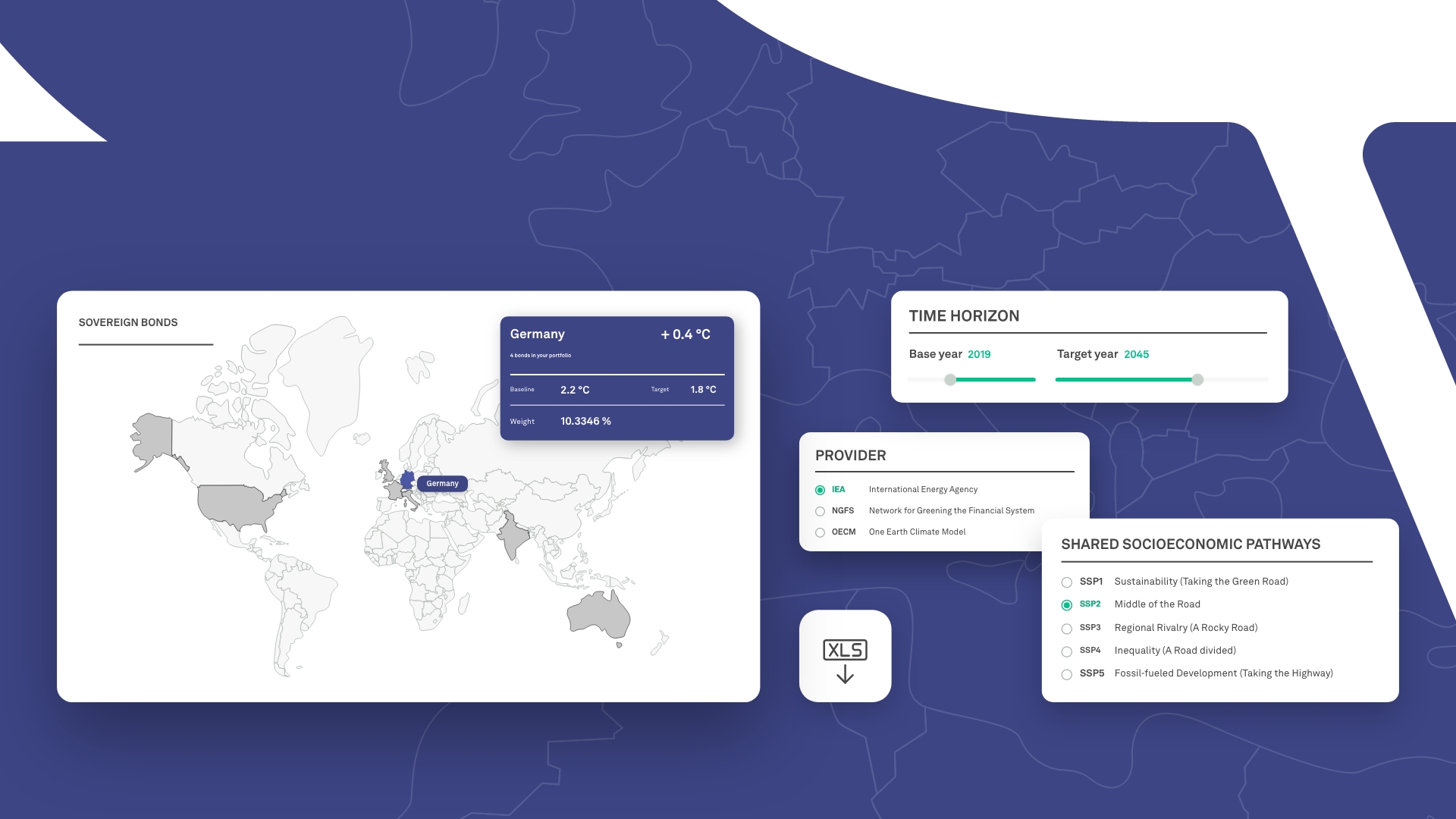

XDC Portfolio Explorer: Sovereign Bonds Module

You can now access the °C values for government bonds of over 165 countries through XDC Portfolio Explorer. This optional module allows you to measure and manage the temperature alignment of your multi-asset portfolio covering listed equity, corporate bonds, as well as sovereign bonds through one simple platform.

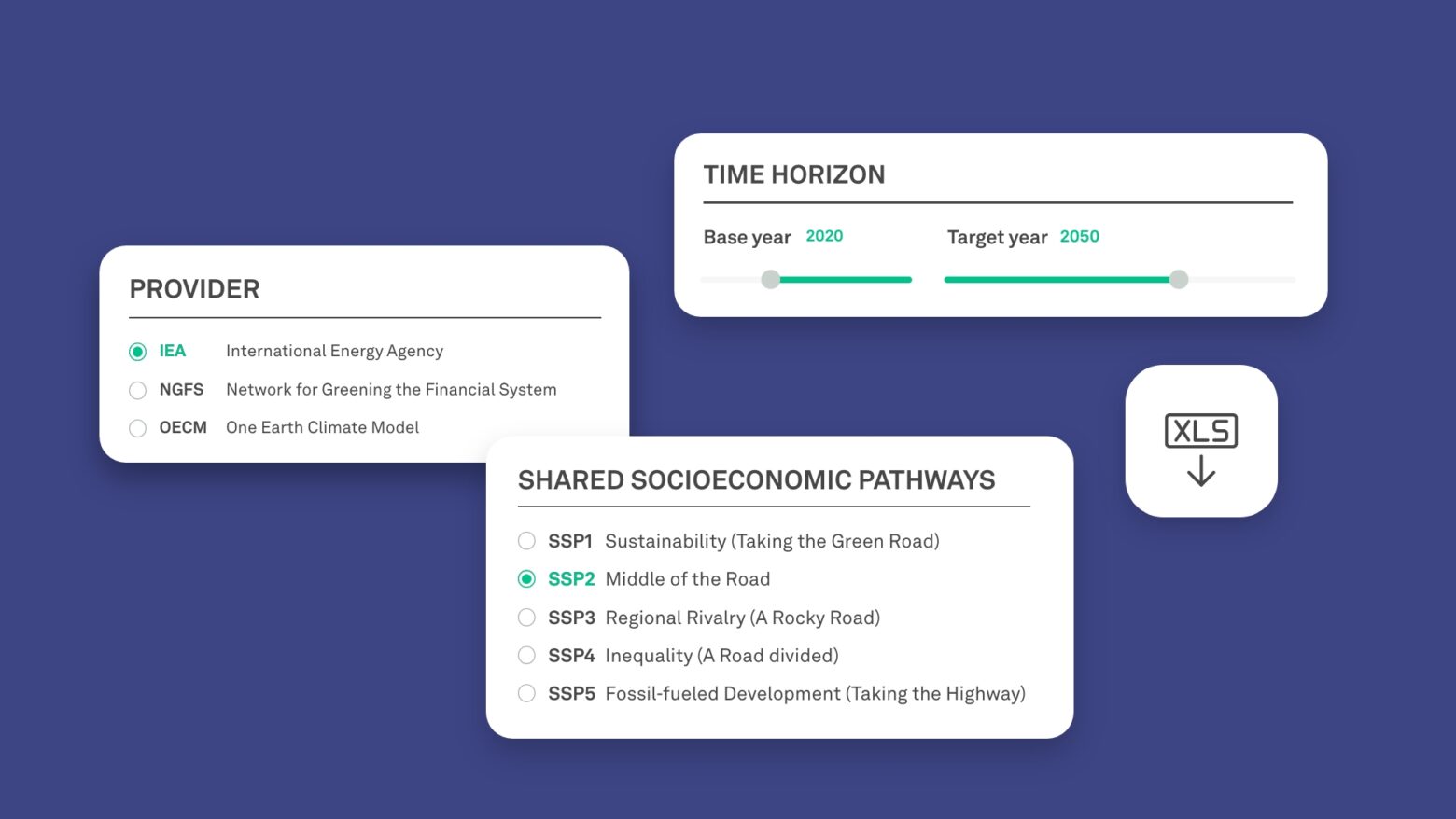

NGFS, IEA or OECM – you choose

The global goal is clear: to limit global warming to 1.5°C or at least well below 2°C. But there are different roadmaps or ‘mitigation scenarios’ to get us there. From now on, you can specify which of these benchmarks you want to measure your portfolio against. Choose between 2°C, 1.75°C or 1.5°C scenarios from the International Energy Agency (IEA), the Network for Greening the Financial System (NGFS) or the One Earth Climate Model (OECM).

Select your SSP

The forward-looking projections made in our XDC calculations are based on assumptions about emissions and economic growth derived from the so-called Shared Socioeconomic Pathways (SSPs). These are widely recognized narratives about different futures, ranging from ‘Sustainability’ (SSP1) or ‘Fossil-fueled Development’ (SSP5) to ‘Middle of the Road / Current Trends Continue’ (SSP2). XDC Portfolio Explorer now lets you choose which of the five narratives should be used to calculate the Baseline XDCs in your portfolio.

XDC Portfolio Explorer: Settings (PREMIUM)

Flexible timeframe

Adapt the timeframe for analysis to best suit your strategic goals and reporting requirements. Choose anything between 2030 and 2050 as your end year.

Download straight to Excel

Work to adjust your portfolio alignment in-software, immediately see how rebalancings would affect your portfolio climate impact and which securities show the best / worst climate performance. When you are ready to integrate these results into your daily work and processes you can now download straight to .xlsx to make the transition seamless.

All these improvements are included for Premium users of XDC Portfolio Explorer, with Sovereign Bonds available as a fee-based additional module.

Send us a note to get the °C for your Sovereign Bonds or to gain full access to Premium functions. And if you’ve never tried XDC Portfolio Explorer, start with our Free version today.